How, where, when, and for how long your firm stores confidential corporate, employee, and client documents is not only an area of concern for organizational policies, it’s a critical compliance requirement that all financial services organizations and their employees must follow. Whether it’s new account opening documentation, AML/KYC, account statements, advisor commission statements, etc., you name it, having a secure, accessible, and structured record of confidential information via a document retention policy isn’t just useful—it’s the law.

While adhering to compliance and document retention policy requirements often comes with technical challenges along with the cost of creating, distributing, storing, and destroying confidential documents, failing to follow document retention policy requirements comes with a much more costly price tag. Following the guidance set out by regulatory bodies as a means of buttoning up your document retention policy and avoiding steep penalties pays its dividends.

So how exactly can your firm ensure you’re maintaining confidential records and adhering to—or better yet, exceeding— document retention compliance requirements?

Fortunately, technology solution providers like FutureVault’s secure Digital Vault platform provide firms and advisors with the solutions and confidence to stay ahead of the curve.

What is Document Retention?

Document retention, also referred to as records retention, is the method and practice of storing, maintaining, and archiving important and confidential information over a required period of time. Whether it’s administrative paperwork, financial performance reports, new client agreement forms, and onboarding documentation, confidential information processed across your front, middle, and back offices every day must be stored in an accessible and secure location.

Documents (records) are essentially considered evidence of decisions, transactions, or critical actions that take place, and as such should be kept as long as required—or for as short a period as necessary–by regulatory, legal, or business governance.

While organizations may put forth their own set of document retention and record retention policies (for example, keeping client records for a period of 5 years), in the case of financial services organizations and other highly regulated industries, there will almost always be a legal and regulatory requirement to maintain, manage, and archive information for a designated period of time. Regardless of what that time period looks like, it’s important you are able to access information, organize it, and keep it safe—the exact reason why having a document management system is so important.

| 💡 Note: Whether your organization has made the move to completely digital processes or you’re still relying heavily on paper-driven processes and paper archives, you will need to keep track of how long these files need to be kept, access older information when you need it, and know that confidential information is kept safe and secure. |

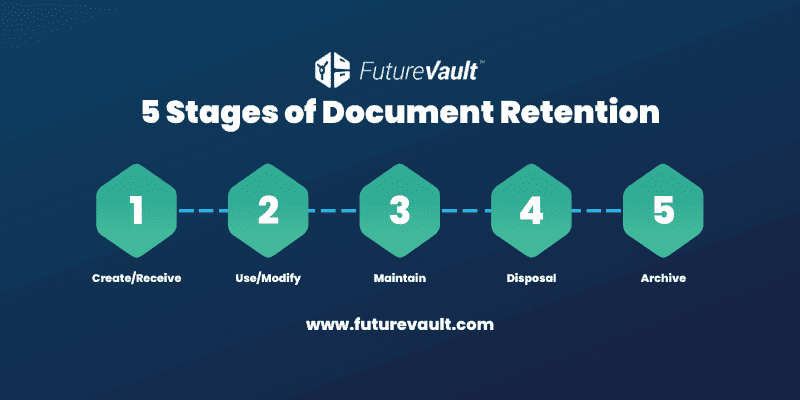

5 Stages of Document and Records Retention

The following diagram provides an overview of the critical document retention “stages” that all firms and financial advisors are required to follow to ensure compliance is being met.

Why is Document Retention Important?

Document retention is important for several notable and significant reasons.

First, document retention plays a significant role for your organization and staff from a process point of view as it relates to records maintenance. Establishing a good document retention policy and framework across front, middle, and back offices ensure that everyone is operating under the same guidelines and adhering to the same internal processes around documentation.

In your day-to-day business operations, having immediate access to files when you need them, archiving old files (so your system doesn’t get cluttered), and removing outdated customer information keeps your firm from making costly mistakes, lower the chances for human error, and ultimately drives productivity where it matters.

Second, it’s also important for compliance and legal reasons. In the United States, Canada, the UK, and other places across the world, document retention requirements exist for financial record keeping under anti-money laundering legislation and terrorist financing regulations; as a financial services organization, credit union, or money lender, you have a responsibility to work with the government to prevent these types of crimes—and this means being able to evidence and access documents whenever you need them.

Last but not least, document retention is important for privacy reasons, too. Although storing financial information is a legal requirement, keeping sensitive customer data on hand is also a security concern: having confidential files in your office puts you at risk for would-be hackers or data breaches, and keeping files on after the storage requirements are fulfilled can open you up to additional legal risks. Having the right platform in place to solve your document retention requirements keeps your client’s confidential information and data safe, secure, and worry-free.

It’s important to note that independent advisory firms and financial advisors operating under and within a larger umbrella organization are still required to follow document retention requirements—document retention is not just an obligation for larger organizations or tied to head office management.

Document Retention Policies & Regulatory Compliance Requirements

Adhering to document retention policy requirements can be difficult, especially for smaller independent advisory firms and financial advisors. Without the staffing and/or technology resources of a large firm, it can be challenging to keep track of what files are being stored where, for how long, and when they can be removed. Failing to do so correctly can have consequences for both you and your company, and not knowing the requirements can turn an information request or an audit into a major headache.

Penalties for noncompliance with document and record-keeping can range from a reprimand to a suspension, a large fine (to a maximum of $5 million in some scenarios), and even expulsion from the membership body itself.

In North America, the financial services industry is regulated by several governing bodies, including the ones below along with their document retention compliance requirements.

IIROC Document Retention Policy

The Investment Industry Regulatory Organization of Canada (IIROC) is a not-for-profit that sets rules and oversees the activity of investment dealers and trading in Canada. IIROC stipulates that records (which are defined as books, records, client files, information, and other documentation related to your business) should be retained in a safe location in a “durable and accessible form” for a minimum of seven (7) years unless other requirements (either by the IIROC or by other governing bodies) state otherwise.

FINRA Document Retention Policy

The Financial Industry Regulatory Authority (FINRA) is IIROC’s counterpart in the United States. Like IIROC, FINRA is a non-governmental agency; as part of its general record-keeping and document retention requirements, FINRA’s Rule 4511 and Rule 17a-4 require a 6-year retention period for records. FINRA is often the first step before reporting infractions to the SEC.

| 💡Did you know that FutureVault’s secure digital vault and document exchange platform meets FINRA Rule 4511 and the SEC Rule 17a-4 document retention requirements for Broker-Dealers and RIAs? Contact our team today to learn more. |

SEC Document Retention Policy:

The Securities and Exchange Commission (SEC) is a US organization given jurisdiction to regulate financial activities across all public securities markets and the financial reporting of public companies. Whether you’re a Broker-Dealer or provide financial advisory services, you could come under the SEC’s umbrella, so it’s important to make sure your office is fully compliant. Like the IIROC, the SEC’s document retention policy covers a seven (7) year term.

Following this guidance not only protects your organization from fines and costly mistakes, but it also streamlines audit requirements, freedom of information requests, or requests from government agencies—all of which could be stressful, if your documents and records are not organized, stored, and secured accessibly.

What Does Successful Document and Records Management Look Like?

Successful document and records management systems should be easy for your firm and its designated administrators to access, secure enough to protect your client’s information, and intuitive for your workflow and day-to-day needs. We recommend reviewing and considering the following:

➜ Customizable security, access, and permissions: not every employee should be able to access every file across the many different functions, departments, and offices. Document access should be configured based on specific employees’ needs to know, allowing only designated users to access certain data.

➜ Easy document retrieval & storage: designated users should be able to access documents and other records immediately; data should be centralized (whether physically in your offices or on a cloud system), easy to maintain, and easy to share, be it on your own system for employees or through a public portal for your clients.

➜ Audit support: being able to find documents to support your audit is a necessary requirement, but being able to find them quickly and easily can also save you money. Having a system that supports the auditing process can cut down on auditor hours and lower your fees.

➜ Built-in automation: a good system will be able to track and maintain your records automatically over their life cycle, from origination to access, storage, archival, and classification.

The best decision your firm can make when it comes to any document retention policy is moving forward with a system you don’t have to think about. At the end of the day, the best tool for your organization is one that’s both easy to use and reliable for you, your administrators, your advisors, and your clients.

Navigating Document Retention Requirements with FutureVault

The best and most certain way to meet and exceed document retention compliance requirements is to integrate technology into your back and front office processes. Platforms, namely FutureVault’s Digital Vault, can save your organization considerable time and money by ensuring compliance requirements are embedded and integrated into your everyday workflow and processes. Essentially becoming second nature so that you don’t have to spend any additional time worrying.

Here’s how FutureVault is successfully helping institutions, firms, and advisors successfully meet document retention policies along with other compliance requirements.

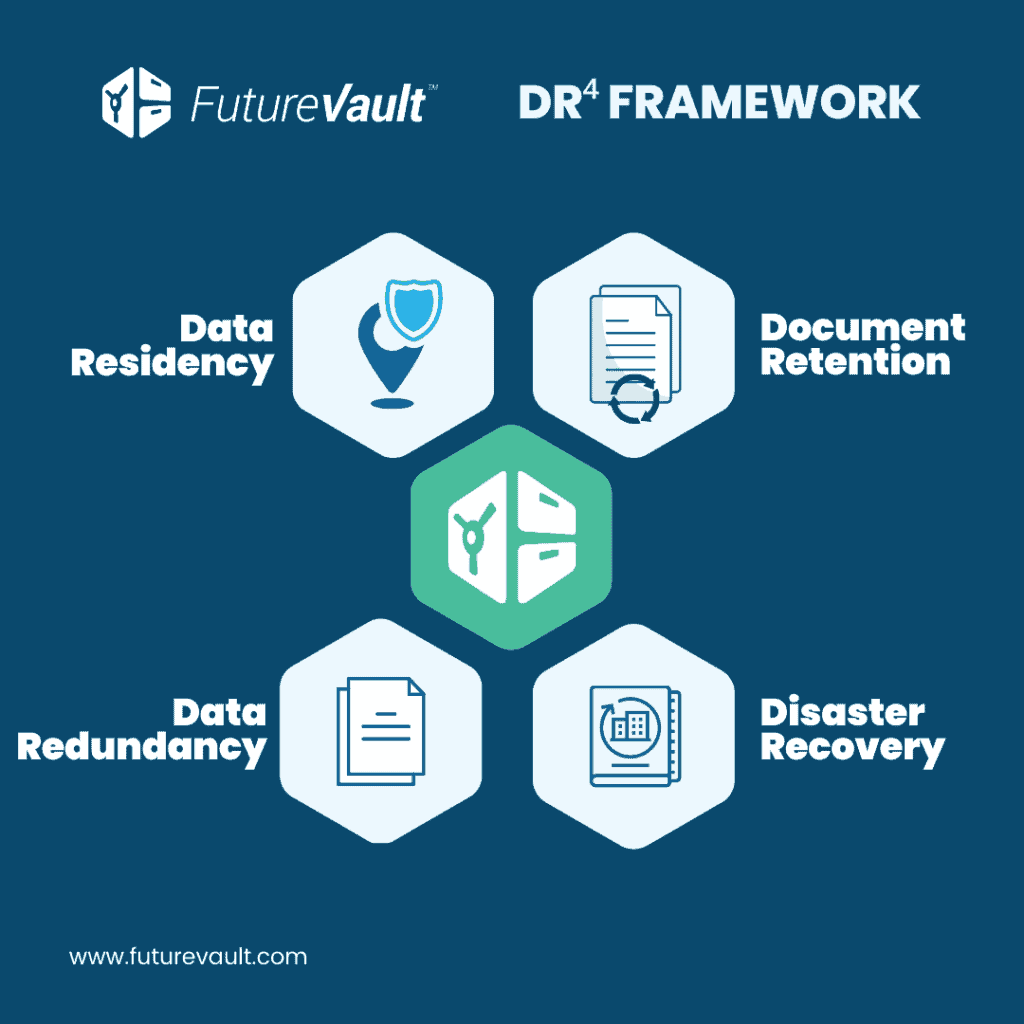

1. Our ‘DR⁴’ Framework

‘DR4’ (Data Residency, Document Retention, Disaster Recovery, Data Redundancy) is an information security and compliance framework our platform offers that enables firms and service professionals to exceed security standards and regulatory requirements. This framework is all about preserving the security and integrity of confidential information and documents.

Here’s a little bit more about each item below.

Data Residency: FutureVault ensures your data is encrypted and backed up in different regions, ensuring your data residency requirements are met.

Document Retention: FutureVault maintains historic copies of your data and your clients’ data to follow your own compliance framework.

Disaster Recovery: FutureVault’s backup and disaster recovery plan meet stringent requirements to prevent data loss and service interruption.

Data Redundancy: In addition to constant backups, documents are replicated and converted into PDFs once ingested into the platform, with the original document being maintained.

2. Security and Compliance Certifications

FutureVault is PCI DSS and SOC 2 Type II compliant as well as adhering to CIS standards—with these certifications, FutureVault is able to demonstrate and evidence that our internal protocols and risk frameworks meet security and compliance requirements, providing your firm with assurance and the confidence you need to know that your confidential employee and client information is kept safe and secure.

3. Robust Security and Compliance Features

In addition to the above, FutureVault’s platform was purposely built to streamline secure document exchanges and document storage, essentially meaning our platform comes equipped with a robust feature set to address compliance and operational-related challenges. Below is a list of a few significant features:

➜ Fiduciary audit trail to confidently track and log all user interactions and activity taking place within Vaults for transparency, accountability, and peace of mind.

➜ Trusted Advisor permissioning model, which happens to be a patented feature, enables FutureVault users (across all levels) to grant collaborative access to third parties and Trusted Advisors.

➜ Bulk Download capabilities to securely export confidential and important corporate, employee, and client information at once for safe record-keeping or to fulfill audit requests.

➜ eSignature integrated workflows to automatically create user Vaults, in addition, to automatically (and securely) depositing signed documents within Vaults reducing back-and-forth exchanges, while improving retention and accessibility. Importantly, our automated eSignature workflows automatically route and file signed documents in the correct file location they need to be stored, saving significant time, money, and compliance headaches.

➜ Secure Inbound-Only Email Ingestion that allows Vault users and their Trusted Advisors to email confidential documents directly into a secured location within the Vault, avoiding unnecessary and insecure back-and-forth email exchanges.

➜ Multi-tiered access capabilities allow institutions and firms to improve information governance and accessibility by managing back, middle, and front office documents, including client documents, within one secured environment, all with different levels of access and views.

4. Digitization Capabilities

Last, but certainly not least, FutureVault affords institutions, firms, and advisors with the ability to take physical paper directly out of the office (safe from misfiling, fires, water damages, etc.) and ‘store’ critical information assets directly on the cloud via bulk uploads and secure transfers to convert paper archives, including historical corporate records, into digital copies where they remain secured as “evidence” for internal use as well as for external organizations such as regulatory agencies and third-party auditors.

Moving Forward with Your Document Retention Policy Requirements

From Independent Broker-Dealers and advisory firms/RIAs to Credit Unions, Banks, and Family Offices, every type of financial services organization remains responsible for following and adhering to both internal and regulatory document retention policy requirements.

Fortunately, technology solution providers like FutureVault’s secure Digital Vault platform provide firms and advisors with the solutions and confidence to stay ahead of the curve in order to meet document retention policies along with other critical compliance and data security requirements.