With such an accelerating and dizzying rate of AdvisorTech options available, making the right technology decisions and developing the right strategy for building your advisor technology stack becomes all the more critical. Studies are coming out on the challenges that advisors are having in adopting the right technology including these facts from Cerulli and the 2022 InvestmentNews Advisor Survey:

- 94% of practice management professionals find limited technology integration creates productivity challenges.

- 57% of advisors say the lack of integration between their core applications is the most significant pain point with technology.

These industry tech difficulties have led to a growing debate between all-in-one and best-of-breed technology platforms.

To better explore these tech issues, we reached out to Institute members Daniel Kenny, Chief Executive Officer, and Kristian Borghesan, Chief Marketing Officer, of FutureVault – an industry leader in digital vault and secure document exchange solutions and pioneers of the Client Life Management Vault. Their firm was recognized by FinTech Global as a top 100 most innovative global WealthTech solution provider along with receiving recognition from a variety of industry publications including WealthManagement.com and Wealth Professional.

Having developed their digital vault technology platform into a best-of-breed solution for the wealth management industry, we asked questions to better understand the issues and decisions they practically had to grapple with.

Hortz: What exactly does ‘Best-of-Breed’ tech solutions refer to?

Kenny: “Best-of-breed” refers to technology solution providers that are regarded as top solutions in one or two categories and providers that are hyper-specialized in what they offer, their approach, and who they work with, often within a particular vertical or segment.

A best-of-breed ecosystem approach is a technology implementation strategy where firms deliberately move away from siloed implementations and/or do not rely on a single vendor to deliver technology. Instead, firms leverage an open technology architecture, enabling multiple best-of-breed solutions to work in collaboration.

A best-of-breed ecosystem includes solutions that span the end-to-end wealth management delivery process across the organization and across all functional requirements to deliver efficiency and value at every intersection. It is about bringing together the best solutions in their respective domains and areas of expertise; solutions that continue to demonstrate delivery of success, provide seamless integration and connection with one another, and have experience working with one another.

It might be helpful to look at an integrated best-of-breed ecosystem implementation as a well-thought-out, defined, and very strategic roadmap toward success that considers the functional requirements across the organization and has a deep understanding of the long-term vision for the future. Best-of-breed solutions de-risk digital transformation strategies and increase the likelihood of success, reduce the number of resources, technology learning curves, disconnected or disjointed workflows, regulatory hurdles, poor client experiences, etc.

Ultimately, it is about future-proofing your business and eliminating friction points to maximize output and scale.

Hortz: How did this concept evolve and why is it an important issue for advisors to consider?

Borghesan: Over time, and certainly when we look back over the last 3-5 years, we have witnessed first-hand the transformative shift that the wealth management industry has gone through. This has led to a massive technological evolution where we have seen more and more of a need, and an overall appetite, across key stakeholders and decision makers for adopting the latest tech solutions.

Technology’s role across the industry has evolved to the point where tech is quite literally at the intersection of every major area and process within modern wealth management. Every bit of interaction with teams and clients is tech-enabled, if not tech-led.

As a result, we are seeing herds of new providers emerge— the good, the bad, and the ugly. This is precisely why the concept of best-of-breed is so important when discussing technology—as a firm or a wealth professional, you want to always ensure that you are in the best, most capable hands and are working with technology providers that are known to deliver the best solutions. This is important for everyone; for your home and back-office teams, for your staff and advisors, and most importantly, for your clients.

To further add to the importance of a best-of-breed approach and tying back to what Daniel mentioned, this type of strategy recognizes that the many different aspects of wealth management such as financial and estate planning, secure document handling, and the digital vault component, risk assessment, books and records compliance, portfolio management, and so on, are often best served by distinct and specialized technologies. By assembling a portfolio of the best tech solutions, we are seeing firms and advisors create a comprehensive and highly efficient technology stack that really addresses and caters to their unique needs and challenges.

When talking about the benefits of taking on a best-of-breed approach, they speak for themselves. Ideally, a best-of-breed strategy allows firms to leverage innovations across specific domains without being constrained by the limitations of a monolithic, all-in-one solution. This approach acknowledges the dynamic nature of the wealth management landscape and the importance of agility and adaptability in meeting the evolving demands of wealth management.

Hortz: What are the biggest risks firms need to consider when working with multiple tech providers?

Kenny: Implementing and rolling out new technology, whether it is one solution or many, inherently comes with a set of risks and considerations. This is something that should always be communicated to any buyer of new tech.

When we are talking specifically about a best-of-breed approach, there are three fundamental risks and concerns you need to start with:

The first would be data protection and information security when dealing with multiple vendors that may be and likely are responsible for managing client data.

The second is the integration capabilities and reliability of APIs to connect and create a seamless experience across multiple tools.

The third, which is an extension of the integration piece, is all about the interoperability of teams and workforce, ensuring that the vendors you select can demonstrate a working relationship.

This latter point is an area that our team at FutureVault strongly values and is core to our overall corporate strategy. We have been able to build and establish relationships with other best-of-breed solutions where we not only demonstrate our ability to integrate with other providers but also demonstrate an active working relationship with our partners and our customers.

Hortz: When is a tech solution considered to be a best-of-breed solution?

Borghesan: Being labeled as a best-of-breed solution really means that providers are known for core competencies and specializations; when they have demonstrated their ability to meet and exceed expectations with real use cases and real customers showing their success; and importantly, best-of-breed solutions demonstrate integration capabilities and interoperability with other solution providers.

As an example, we really take pride in working with and continuing to support the firms we work with by providing meaningful solutions to better engage and drive conversation with clients, to meet books and records and document retention requirements, and to streamline and gain more than 30% in back office and administrative efficiencies through automating document-driven processes like delivering multi-custodial client statements.

For us, that means a large part of our growth strategy as a company is investing time and resources into building integrations and relationships with other best-of-breed providers in the industry. We are proud to partner and integrate with other best-of-breed solutions across the different categories ranging from CRMs, digital financial wellness, and planning solutions to portfolio management software, e-signature tools, risk management software, and proposal generation software.

Hortz: What kind of technology, design, and partnership decisions did you make in creating your best-of-breed solution?

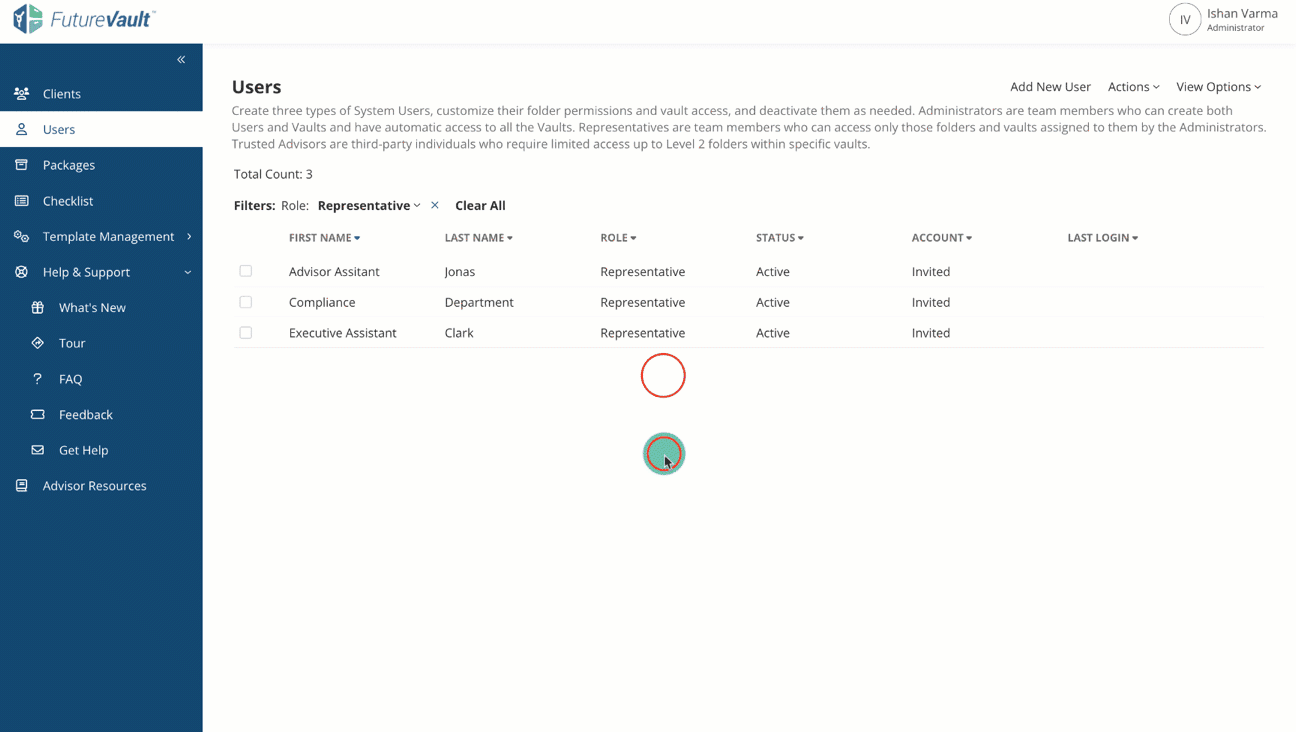

Kenny: We have made very intentional and strategic decisions across technology, design, and partnerships that allow us to continue building on top of our foundation and core competencies to position us as the best digital vault and client life management (engagement) solution for the wealth management industry. A few key decisions we made and ongoing considerations that we continue to kick around that we often find ourselves discussing with our strategic partners include:

Technology Decisions:

- ➜ Specialization: Strategically selecting a specific area or functionality within the industry to specialize in, addressing a particular need or pain point effectively.

- ➜ Innovation: Investing in continuous research and development to stay at the forefront of technological advancements and incorporate innovative features.

- ➜ Scalability: Designing the platform to be scalable, ensuring it can accommodate increased data, users and transaction volumes as the client’s business grows.

- ➜ Interoperability: Developing with open standards and robust APIs to facilitate seamless integration with other systems and technologies.

Design Decisions:

- ➜ User-Centric Design: Prioritizing user experience through intuitive and user-friendly interfaces, enhancing usability for both clients and internal users.

- ➜ Customization: Providing flexibility and customization options to meet the unique needs and preferences of individual clients or businesses.

- ➜ Mobile Accessibility: Considering the growing importance of mobile access and design interfaces that are responsive and optimized for various devices.

Partnership Decisions:

- ➜ Integration Partnerships: Establishing partnerships with other technology providers to enable seamless integration with complementary tools, creating a more comprehensive ecosystem (which we refer to as a ‘best-of-breed ecosystem’) and foster working relationships to help firms scale.

- ➜ Collaboration with Industry Experts: Collaborating with industry experts, financial advisors and wealth management professionals to really understand the evolving needs and challenges that persist across the industry.

Hortz: How can an advisor move forward with a best-of-breed digital transformation strategy if they choose that route?

Borghesan: Moving forward with and implementing technology in general, and especially a best-of-breed technology strategy, really involves thoughtful consideration and diligence. There are a ton of considerations here, but it really starts with understanding three fundamental areas before going out to the market and assessing vendors.

The first place, and where every firm should always start, is defining the strategic objectives and goals of your firm. Next, assessing and identifying current needs and pain points and how technology can address them. And the third one revolves around initial research and getting an overview of the solution providers in respective categories.

Industry resources like the Kitces AdvisorTech solution map can provide firms with an initial overview of what solutions may be considered top performers in their respective categories. We would also recommend discussions with your existing technology partners and/or industry peers.

Hortz: From your experience, can you recommend to advisors how they can make the right strategic “bet” with tech partners and can de-risk their decisions?

Borghesan: It really comes down to having a solid vendor due diligence in place to address everything (and more) that we have discussed as far as key risks and considerations go; to have a well-defined and structured vendor due diligence process.

The area I would double down on is the interoperability of your partners both from an integration and a working/collaborating standpoint. We have all heard the horror stories of when this piece fails, everything else comes crashing down as well. Do not let bad blood between your vendors derail any chance of success you have.

Kenny: Perhaps one last bit of advice here would be for firms not to do it alone. Whether you are looking to introduce an entirely new set of technology partners or if you are looking to introduce one new partner into the mix, we always recommend leaning on your existing relationships to get a feel for fit and interoperability. And fortunately, when you are dealing with technology providers considered best-of-breed like us here at FutureVault, you do not have to go it alone.

Technology providers that are well-versed in their respective areas of expertise and implementations — and with transformation initiatives in general — can play the role of a trusted partner. More than just a vendor, these providers are immersed in the space in which they operate and are able to help your firm streamline processes while providing support every step of the way. Remember that good partners bring experience, expertise, and innovation to the table. And importantly, good partners are in it for your success and to deliver the best results they can.

This article was originally published by The Institute for Innovation Development. The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We operate as a business innovation platform and educational resource with FinTech and financial services firm members to openly share their unique perspectives and activities. The goal is to build awareness and stimulate open thought leadership discussions on new or evolving industry approaches and thinking to facilitate next-generation growth, differentiation, and unique community engagement strategies.